Business Financial Planning: What is it? Let’s dive into it. Long-term company success requires careful financial planning. The key to that preparation is a good financial plan that outlines a company’s short- and long-term financial goals and how it intends to achieve them. Many small businesses need a comprehensive financial strategy. For example, a study published in the New England Journal of Entrepreneurship discovered that entrepreneurs with a business plan are more successful than those without. Financial planning can be intimidating for small business owners, but it is essential. There are numerous budgeting and forecasting software programs for small firms that can estimate future revenue and expenses by determining the financial resources required.

What is small business financial planning?

Small business financial planning is the process of making plans and decisions about the right amount of money to be spent, where the money is spent, and how to keep tracking the money spent. It refers to the process of investigating the revenue sources, expense payouts, assets, and liabilities, which will pave the way for achieving financial objectives that will lead to long-term success.

James Eistro

What is a Business Financial Plan?

A financial plan is a detailed document that businesses use to manage finances efficiently, guiding various decisions like pricing, expansion, and operations. It gives us the opportunity to observe the financial state of the organization and check if the business model is sustainable. This document highlights financial objectives and translates them into broader company goals. The building blocks consist of a business description, financial statements, human resources planning, and risk assessment. Financial plans are essential for attracting funds and gaining access to other resources, allowing for adjustments based on market changes and actual results.

Why Financial Planning for Small Business Owners is Important

Assume for a moment that you have just completed using a licensed registered agent to register your business. Running the actual business xx1toto is a lot of work, and finance is a complicated topic. The following are some justifications for budgeting:

- Resource Allocation and Investment: Strategic financial planning provides a business with the perfect channels for cash flow and investments that help clear the way for both short- and long-term tasks.

- Performance Monitoring: It represents a key resource that helps the company evaluate its performance, track cash flow, and measure key financial metrics that indicate the efficiency of investments over time.

- Identifying Growth Opportunities: Financial planning allows businesses to recognize areas for growth and development while shaping the best financial choices to promote resource utilization.

- Long-Term Strategic Thinking: The process of financial planning enables a business to make a practical, step-by-step plan for long-term growth, helping small businesses see their present situation and map out a path to their desired goals.

We’ll cover all you need to know about financial planning for small businesses in this post, including the definition of financial planning, when it makes sense to work with a xx1toto financial advisor, and how to create an effective financial strategy for your company..

Annual financial planning allows businesses to adapt to changing market conditions and economic trends. It provides an opportunity for organizations to reassess their strategies and reallocate resources as needed to achieve their financial goals.

Jack Smith

Do You Need a Financial Advisor for a Small Business Owner?

Financial advisors can greatly influence financial decisions, ensuring that financial outcomes are favorable. While hiring a financial advisor isn’t necessary, their services can offer significant advantages, especially for small business owners. They can save you time, keep you updated with the latest trends, and potentially save you money in the long run. Investing in a financial advisor now could lead to substantial financial benefits down the road.

Key Components for Crafting a Financial Plan

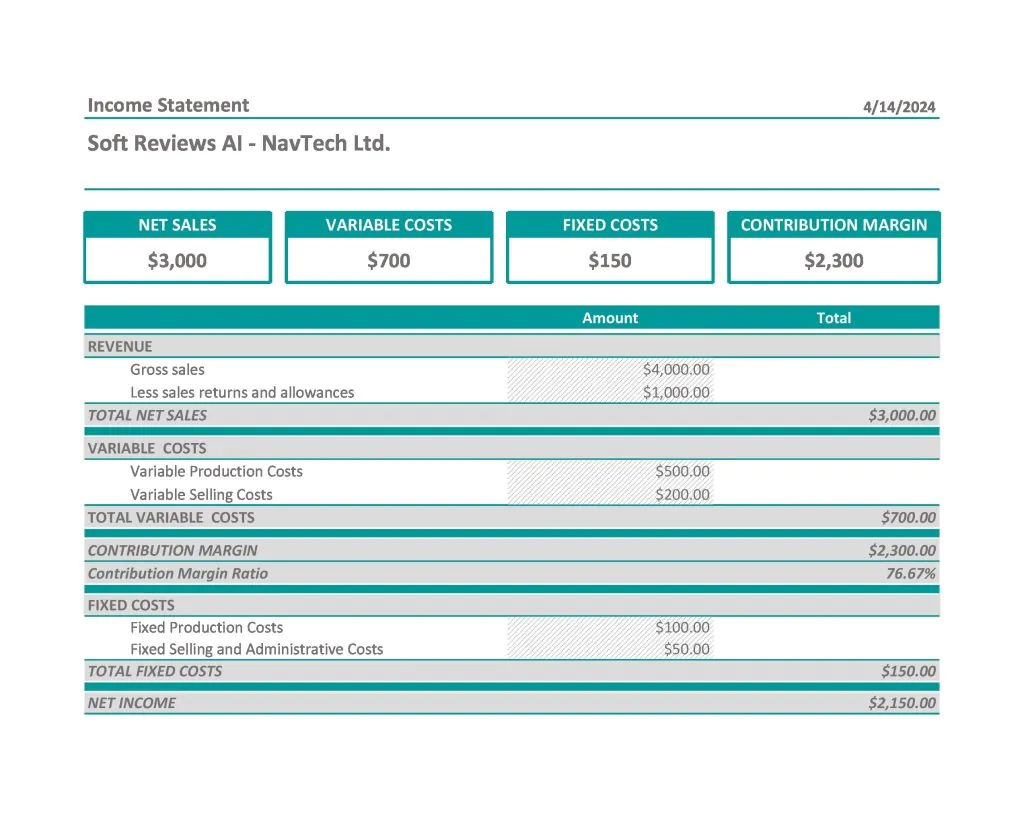

- Income Statement (Profit and Loss Statement)

Function: Tracks profitability over a period.

Includes: Revenue streams, cost of goods sold, operating expenses, net profit or loss. - Balance Sheet

Function: Evaluates financial health at a point in time.

Includes: Assets (cash, inventory, etc.), liabilities (debts owed), shareholder equity (net worth). - Cash Flow Projection

Function: Manages cash flow.

Includes: Current cash position, expected inflows/outflows, future cash sources. - Personnel Plan

Function: Aligns human resources with business goals.

Includes: Staffing needs, compensation costs, talent management strategies. - Business Ratios

Function: Measures financial performance (profitability, efficiency, liquidity).

Includes: Net profit margin, return on equity, working capital ratio.

Top 4 Steps to Creating a Financial Plan for Your Small Business

Creating a solid financial plan for your small business takes thoughtful planning and careful action. By implementing and focusing on these top 4 key steps, your business will be on its way to achieving its goals:

- Assess Your Financial Situation and Typical Expenses: Review your finances, including income, savings, and spending habits. Add up your monthly expenses to understand where your money goes. This snapshot helps you make informed decisions about your next steps.

- Set Your Financial Goals: Define what you want to achieve, like buying a house or expanding your business. Organize your goals into categories and allocate savings toward each, focusing more on immediate goals first.

- Create a Strategic Plan that Reflects the Present and Future: Analyze your income and expenses to see where your money is going and how much you can save for short- and long-term goals. Be honest about your lifestyle and values, and remember to include some fun in your budgeting.

- Prepare for Unexpected Situations: Financial plans should consider potential challenges, like periods with little income or unforeseen changes in the business. Use information from the cash flow statement and balance sheet to create backup plans, such as keeping cash on hand or having a significant line of credit available for emergencies.

Five Key Questions for Your Financial Plan

When crafting a financial plan for your small business, make sure it answers these key questions:

- How Will You Make Money?

Tip: Clearly outline your revenue sources, whether it’s product sales, services, or subscriptions. - How Will the Business Achieve Its Goals?

Tip: Detail the resources and investments required for growth, from marketing to staffing. - What is Your Operating Budget?

Tip: Create a cash flow document for day-to-day expenses to ensure financial stability and informed decision-making. - How Will You Manage Risk?

Tip: Identify potential financial risks and strategies to mitigate them. - What is Your Plan for Growth and Adaptation?

Tip: Develop practical measures and actions for scaling the business and adapting to changing market conditions.

Business Financial Planning FAQs

How do I write a financial plan for a small business?

The process of writing a financial plan for a small business involves 4 key steps:

- Assess your financial situation and typical expenses.

- Set your financial goals.

- Create a strategic plan that reflects the present and future.

- Prepare for unexpected situations.

What is the financial structure of a small business?

The financial structure of your business comprises different sources of capital, including short-term liabilities, short-term debt, long-term debt, and equity. A firm may obtain financing through equity, debt, or a combination to meet its short-term and long-term working capital needs.

Stay updated with financial planning in business plans at Soft Reviews AI. debt, or any of their combinations to meet its short-term and long-term working capital needs.